Power of Compounding

Remember the old adage? ‘Money doesn’t grow on trees’. Yes, it does not. However, if you plant the right seeds, nurture the soil consistently, and ensure your plant gets enough sunlight, it will eventually bear fruit for you.

Let me share an interesting story about the Chinese bamboo tree. Surprisingly, this tree remains underground for the first four years without showing any visible growth. However, in the fifth year, it experiences an extraordinary surge, growing up to 90 feet in height.

Similarly, when you invest in the right companies, your returns over time can more than make up for the periods when your stocks underperformed. Patience and the right choices often lead substantial growth.

A key lesson in life: consistency is crucial, whether it is in your work or with money. Over time, things compound and yield significant results.

Whatever you earn—whether it's interest, dividends, capital gains, etc.—should be reinvested into your account. Over time, the original amount grows as these returns keep accumulating. If you invest for the long term, the chances of losing money are minimal, almost non-existent. As the renowned American investor Charlie Munger always said, "One should never interrupt their stock portfolio unnecessarily or prematurely, as most of the benefits come at the end." It's a simple life principle—good things take time.

Another key point to remember is that success favors the early movers, so you need to act swiftly to reap the rewards.

All you need to do is start as early as possible and reinvest your earnings—essentially, keep adding small amounts consistently over a long period, say ‘n’ years, and watch your Rs. 10 lakhs grow into Rs. 10 crores. But this kind of growth is only possible if you seize the opportunity to start investing at a young age or plan for the future. Whether you are saving for your child's education, marriage, foreign tours, or planning to buy a house, car, or bike, early planning can make all the difference.

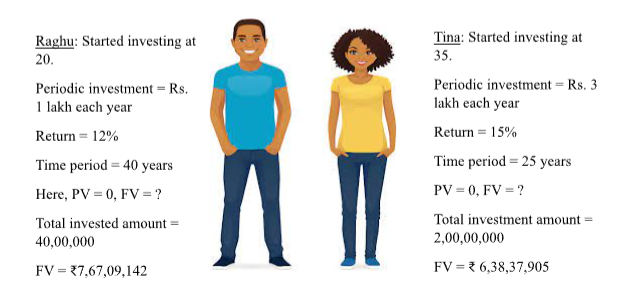

Let us take you through an example. We will compare two cases: -

Both retire at 60 years of age.

The CI formula is :-

A = P(1 + r/100) n and CI = A – P

where, CI is compound interest, r is rate of interest A is amount, P is principal and ‘n’ is no. of years

Similarly, FV = PV (1 + R)N

where, FV is future value and PV is present value

In the example above, we can clearly see that despite Tina investing a larger capital at a higher interest rate, her investment didn’t achieve the same level of growth as Raghu’s. This highlights the importance of starting early and staying invested for the long term, regardless of the initial corpus or rate of return. The more frequently compounding occurs, the greater the results.

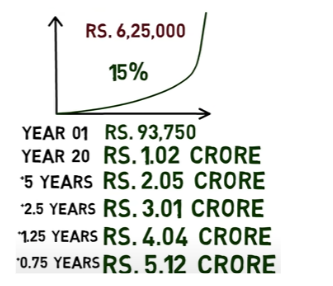

I will give you one more example. Suppose, initially you make a one-time investment of Rs. 6,25,000 to buy high growth stocks. Your money compounds at the rate of 15% for the next 30 years.

Use the compound interest formula to calculate these amounts.

A = P (1 + r/100) n

As you can see in the above picture, you could just earn an interest of Rs. 93,750 in the 1 st year but after 20 years, your amount grew to 1.02 Cr. and within 5 years, it more than doubled to 2.05 Cr. and going further, the growth rate was unbelievable! It grew by 1 Cr. in a period of less than 1 year and your money rose to a massive 5.12 Cr. figure in the final year.

By now you would have gained some confidence and understanding. This is the ‘Power of Compounding’. Small savings and right stocks can change your life! The urge to liquidate returns immediately can be counterproductive to wealth creation and may lead to huge opportunity costs.

Trust the process

Compounding is fundamental to investing. Now, let’s discuss why stock market is the best option to consider among all the other investment avenues.

Equity shares provide the highest rate of return (based on past performance), making them the most profitable investment option. More importantly, they have the potential to outpace inflation, ensuring real wealth growth.

In contrast, traditional investments like savings accounts, fixed deposits, or even gold bonds often see their profits eroded by inflation and taxes, leaving little to no net gain.

The stock market, represented by indices like Sensex and Nifty, serves as a barometer for the economy. It reflects various factors such as RBI 5 source: groww reforms, industry trends, and the growth or decline of individual companies. When a company performs well, its stock prices rise; conversely, poor performance leads to a decline in share value. By seeking guidance from an advisor, investors can even forecast potential market trends for the coming years.

By staying invested in equity for more than five years, you can also even out the effects of volatility in the market.

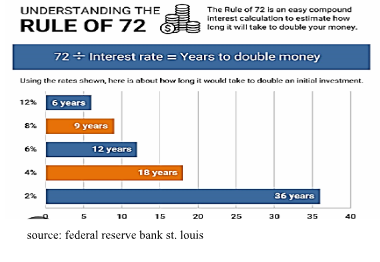

There is a rule of 72

This is an easy way to get an idea of how your money will grow in future.

Excited to see the magic??

Are you willing to stand out??

Goal is to make your money work for you.

Be future ready and take one step ahead, CUZ’

YOGA and COMPOUNDING DONO SE HOGA!

Copyright © 2025 Marquee Investment Manager. All Rights Reserved. Design By Leads & Brands